Calculate my paycheck taxes

Subtract any deductions and. Free salary hourly and more paycheck calculators.

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

IR-2019- 107 IRS continues campaign to encourage taxpayers to do a.

. If you make 55000 a year living in the region of New York USA you will be taxed 11959. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. Your employer will withhold money from each of.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. To determine your hourly gross rate of pay divide your annual salary by 52176 to obtain the weekly rate and then by the number of hours in your standard work week. Your employer also withholds money to pre-pay your federal income taxes.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. That means that your net pay will be 43041 per year or 3587 per month. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. That means that your net pay will be 40568 per year or 3381 per month. It can also be used to help fill steps 3 and 4 of a W-4 form.

How It Works. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. On the W-4 form you file with your employer you indicate how much.

A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Taxable income Tax rate based on filing status Tax liability.

Estimate your federal income tax withholding. Use this tool to. Adjusted gross income - Post-tax deductions Exemptions Taxable income.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. See how your refund take-home pay or tax due are affected by withholding amount. How Your Michigan Paycheck Works.

This number is the gross pay per pay period. Federal Salary Paycheck Calculator. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

Get an accurate picture of the employees gross pay.

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Take Home Pay Calculator

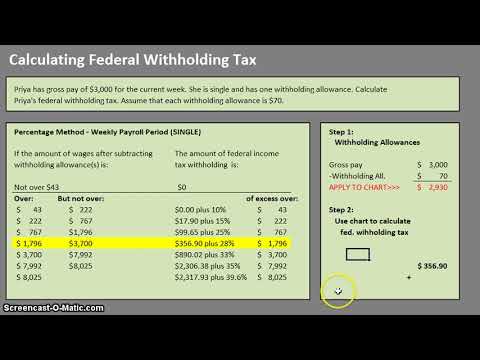

How To Calculate Federal Withholding Tax Youtube

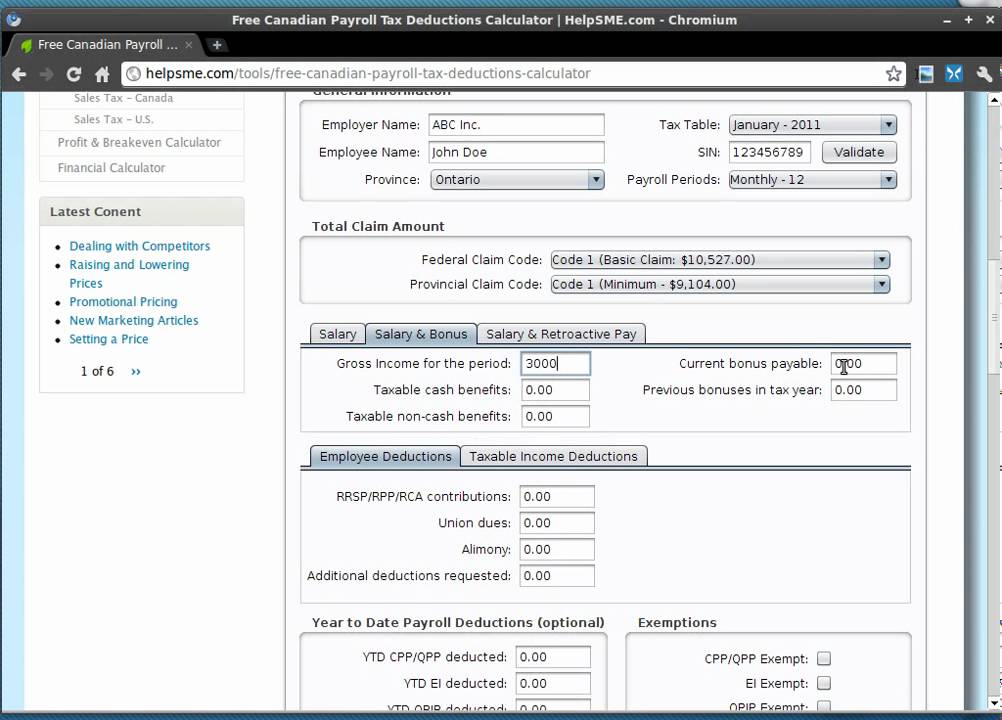

How To Calculate Payroll Tax Deductions Monster Ca

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Avanti Income Tax Calculator

The Measure Of A Plan

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

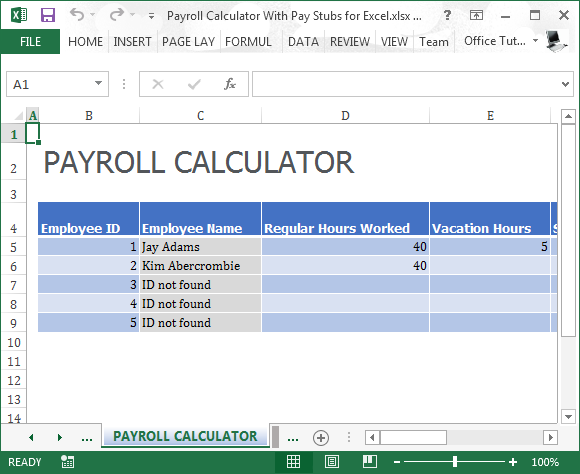

Payroll Calculator With Pay Stubs For Excel

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

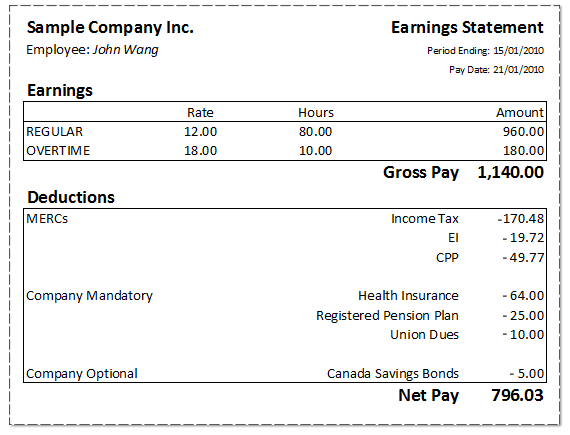

Mathematics For Work And Everyday Life

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022